8 min read

CRM software for high-performance sales teams

Have you come across the the old Army acronym the “The 7Ps of Planning”?

Prior Prevention and Planning Prevents P*** Poor Performance

Well the same holds true for sales forecasting…

Many field sales managers are guilty of charging head-on into an Excel grid; plotting their historical sales data and drawing some nice, fancy, linear lines stretching far into the future. Unfortunately the sales forecasting process requires a little more careful consideration than that. Before building a model there are some key questions to ask and steps to follow:

Insufficient answers to questions like these may lead to picking an inappropriate sales forecasting process for your sales management process model and leave your predictions well off the mark.

To avoid all that I’ve gone ahead and put together a rough guide on what I believe are the key steps and put them in chronological order.

First thing’s first – before we do anything it’s important to understand the market you are operating within. This will affect the type of sales forecasting process you choose.

I like to break this section down into 2 distinct segments I came across in Paul Arinaga’s Sales Forecasting for Busy People: market definition and market characteristics.

Here you need to define the specific areas or niche of the market that your product or service serves. Let’s say for example, you work in the automotive sector. Ask yourself if you target a specific segment of that sector? Is your product geared more towards the assembly of vehicles or after their distribution to the dealer? Are you serving a niche sector of the market? i.e. do you target high-end cars or more those available for general distribution.

Choosing to label your market as simply “automotive” leaves you at risk of undervaluing your actual market share. If you specialize in auto parts, define your market as such. That way when drawing up your sales forecast it’s being done within context of that niche, not in an obviously much larger market like “auto-parts”.

Now that you’ve defined the playing field you’ll be competing on, it’s the role of the area sales manager to look at some of its particular characteristics.

This could include:

Something else you’ll want to figure out early on in your preparation is whether or not you have any hard sales data to work with. If your product is completely new and ready to launch into the market then this obviously isn’t going to be possible. However, if this isn’t your first rodeo there should be something for you to work with.

Now it’s important to remember that data extrapolation only works in steady, stable markets that experience little fluctuation. If there’s a lot of disruptive, unpredictable change then an alternative method of forecasting, such as exponential smoothing should be explored.

Now that you’ve got your basic preparation out of the way it’s time to choose the sales forecasting process that best fits your business.

The two types of sales forecasting process are generally split into two groups: quantitative sales forecasting and qualitative sales forecasting

The so called quantitative methods of sales forecasting are those used with the availability of historical sales data that can be extrapolated to predict future revenue. These methods rely more on sound, mathematical equation than opinionated judgement from expert peers.

3 of the most popular techniques include:

So if you have sales data available research the pros and cons for each of these techniques to find one that best suits your business model.

The qualitative methods of forecasting are the complete opposite of their quantitative cousins; these techniques are subjective, relying more on the opinion of market experts or surveys than any complicated mathematical equations.

That does not make them any less useful mind. They are going to be the best method of forecasting if you are absent of any historical sales data of which you could use.

Some of the more popular techniques include:

Again, before choosing make sure to do some thorough research into which of the techniques you think will be most applicable to your sales process. You can always conduct tests to determine accuracy but it helps if you already have a shortlist from which to work from.

The next step in the sales forecasting process is to make sure the data you’re about to use to conduct your forecast is as clean and accurate as possible. Without it, even the most sophisticated sales forecasting process will struggle to give you any insight.

Think of the idiom garbage-in, garbage-out. Feed a system crap data and it’s going to give you even crapper insight.

A lot of blame is heaped on the field sales guys for this as at the end of the day it’s them entering the data.

But we shouldn’t be so quick to judge.

Often the tools they are given just aren’t suitable for the job. You have to remember these guys spend most of their day travelling, meeting with clients before dashing off again for another appointment. They don’t have time to sit down, fire up a laptop, rifle through a groggy CRM and leave a comment. They need something more intuitive.

Mobile CRM apps are designed specifically to increase data accuracy by making life as easy as possible for the field rep. If they can enter data quickly, in real-time via an easy-to-use application the info is going to be fresh, live and extremely accurate.

This is what you want before conducting a sales forecast.

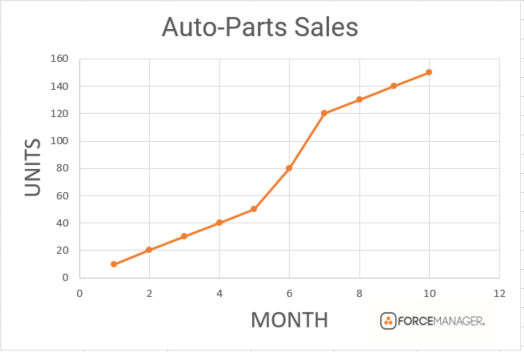

Also, if you are using historical, extrapolated data with the idea of choosing one of the suggested quantitative forecasting techniques then there are a couple of things to watch out for. The first is to highlight any anomalies by plotting your data into a standard excel graph as follows:

As you can see between months 5-7 there appears to be an abnormal amount of units sold during this period of time when comparing it to the rest of the data. Now this could be down to a number of reasons: seasonality, perhaps there was an acquisition or company merger or human error.

If you determine that this was in fact just “rogue” data and a one-off occurrence it’s normally recommended that you remove it completely before continuing with your forecast.

This same logic applies when deciding to use a qualitative method of sales forecasting. Your data, whether gathered from internal reports, markets surveys or expert panels will need to be checked for credibility. If there are other data sets available for alternative market reports, cross check for any obvious anomalies.

The next step of the sales forecasting process is to build out your model and test it. This could be either through an Excel grid or specialized software program, depending on the model you chose to go with.

To do this I recommend you try what is called a Within Sample technique

Basically this means using a set of available data, so your survey, market research or own sales data to forecast a set period of time and then compare it to the known outcomes or results.

If the out-sample forecast error (the difference between the known results and those forecast by your model) is better than the in-sample MANE (mean absolute naive error) then there’s a good chance you’re on to a workable model for you sales process. The more data you have the, better, as you will be able to more accurately compare your output sample deviation over a longer period of time.

If you’re unsure on how to calculate the MANE, it can be down as follows:

Sum of ANE (absolute naive error) divided by the number of ANE.

Don’t worry, we are heading into the penultimate stage of the sales forecasting process as we look to validate the results of our selected model.

So how do we go about this?

First you can try adding some real life variables to the model. For example, imagine a new car manufacturing plant is due to open up in your sales territory. And, as a result of the prowess and due diligence of your well-trained field sales team, you manage to win the account over your competitors.

If everything goes well, within 6 months they’ll be demanding (x) amount of product causing a serious spike in projected sales.

Add this to assumption to your sales forecasting model and record the results. This is extremely easy to do both within Excel and the majority of leading forecast software providers.

Now let’s say your model forecasts an increase in sales by over 400%. You now have to decide whether you think that’s an overly optimistic and inflated prediction or a reasonable assumption based on the opening of the new factory.

To aid in your decision you could fact check it against some previous historical sales data, maybe from the acquisition of a client of similar size or a large increase in orders.

If you don’t have that data available try getting it form a competitor or maybe from a completely different industry, as long as the same logic applies. If the results really don’t match, then perhaps you have to go back and tweak your model. Either the assumptions you made were incorrect or the logic of the model is flawed.

Again, you’ll have to decide what you think is the most likely explanation.

The final step in the sales forecasting process is to now choose the model that worked for your business model.

I’m quietly confident it will have been the exponential smoothing method, as it normally accounts for slight unexpected changes that some of the other models have difficulty adjusting too.

But honestly, this will all have depended on your testing:

The importance of sales forecasting really can not be overstated so please, please, please make sure you don’t skip this part. Testing all of the models on your shortlist, despite being a major pain the backside is going to be a damn sight better than making incorrect forecasts for the foreseeable future.

However, remember whichever model you end up choosing that the data you enter into it MUST be accurate, or as close to it as feasibly possible. Inaccurate data throws any forecast off track meaning all your hard work will have been for nothing!